Understandably, crypto regulation is getting a lot of attention. But for investors looking to allocate capital over a longer horizon, focusing too much on tracking legislation and industry legal woes may be a distraction to long-term success.

So what’s an investor to do when news headlines are luring us in with who Securities and Exchange Commission Chair Gary Gensler is after or what Kevin O’Leary thinks of the SEC? Start a weekly challenge, of course!

I call it the Weekly Digital Asset Power Hour.

I know a lot of financial professionals who block off time for “research” (aka reading news). The challenge is to dedicate at least one of those hours per week to learning about a digital asset. CoinDesk’s Digital Asset Classification Standard has 500 assets waiting for you. (If this at all sounds boring, remind yourself that Warren Buffett has long done this with 10-Ks – oof.)

The more you understand the use cases of individual assets, the better you can diversify beyond bitcoin (BTC) and Ethereum’s ETH, whether that be selecting individual assets or taking an index approach. The data suggests that it may also give you a competitive edge.

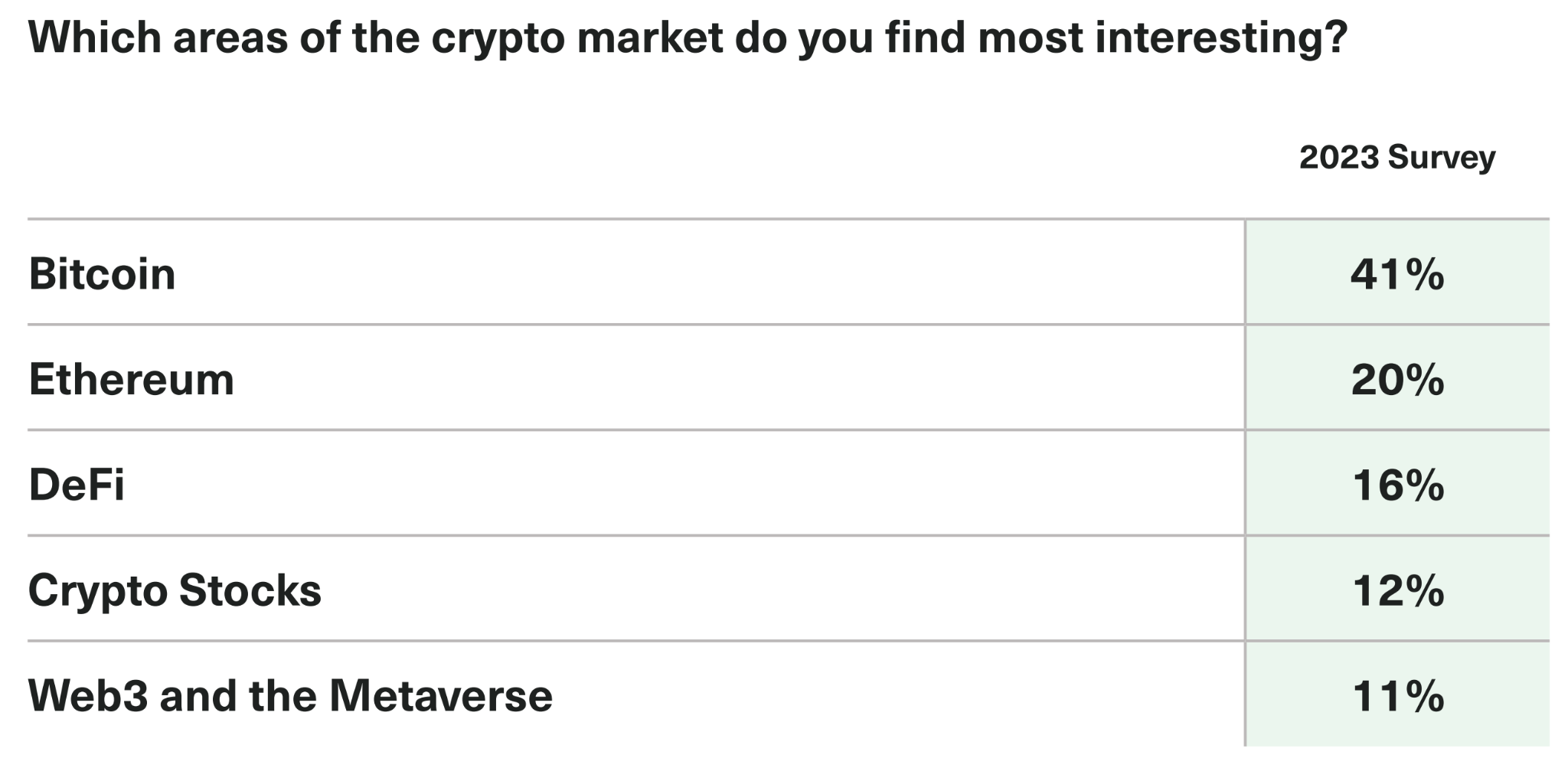

For example, Bitwise recently surveyed financial advisers. One of the questions made me hesitate. The question was: Which areas of the crypto market do you find most interesting?

Source: Bitwise/VettaFi 2023 Benchmark Survey of Financial Advisor Attitudes Toward Crypto Assets

As I looked at the answers, noting BTC and ETH’s dominance with Web3 and the metaverse way behind, I could not help but think, “Are the advisers really answering the question as it’s worded?” Bitcoin is the largest digital asset, but most interesting? I think they were subconsciously actually answering this: What part of crypto do you understand best? Humans tend not to be interested in things we don’t understand, especially when technical. (Don’t ask me to explain how my iPhone works. I am not interested.)

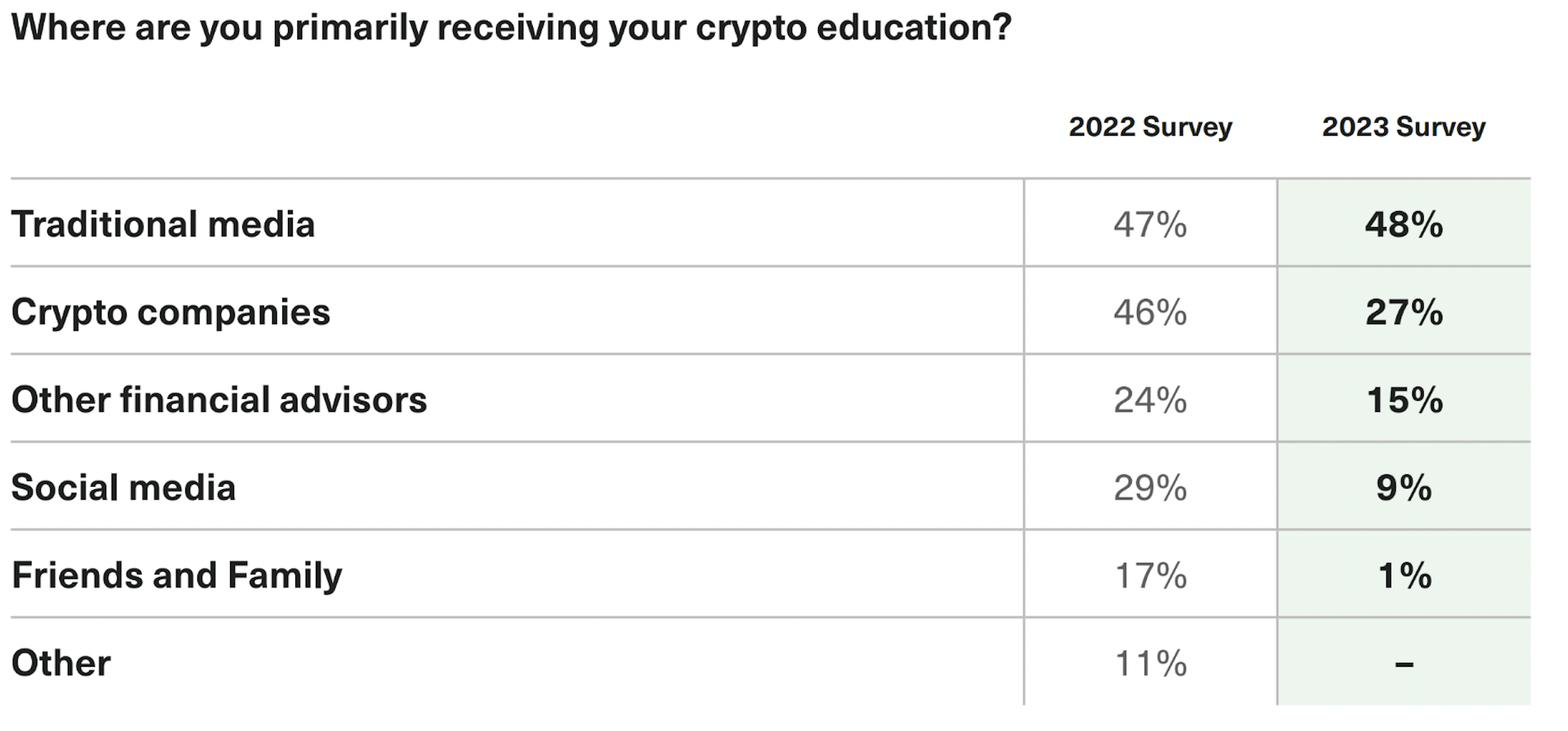

A follow-up question reinforced my inkling. Most advisers are getting their crypto education from traditional media, which focuses on BTC, ETH, regulation and the latest news on the Sam Bankman-Fried saga.

Note: The choices provided in the 2022 and 2023 surveys were slightly different. Numbers may not add to 100% due to rounding and/or survey design.

Why does this matter? It suggests some of the most sophisticated investors – financial advisers – lack broad knowledge of digital assets.

Jennifer Murphy, the CEO of Runa Digital Assets, wrote in a previous version of this newsletter: “Long-term investors would do well to make sure their portfolios include the potential wealth creators that will disproportionately drive market returns in the coming decades.”

The “potential wealth creators” are the crypto use cases that will survive and thrive over the next decade. And one could argue that assets other than BTC and ETH may be larger wealth creators given that being newer means they have a longer growth runway.

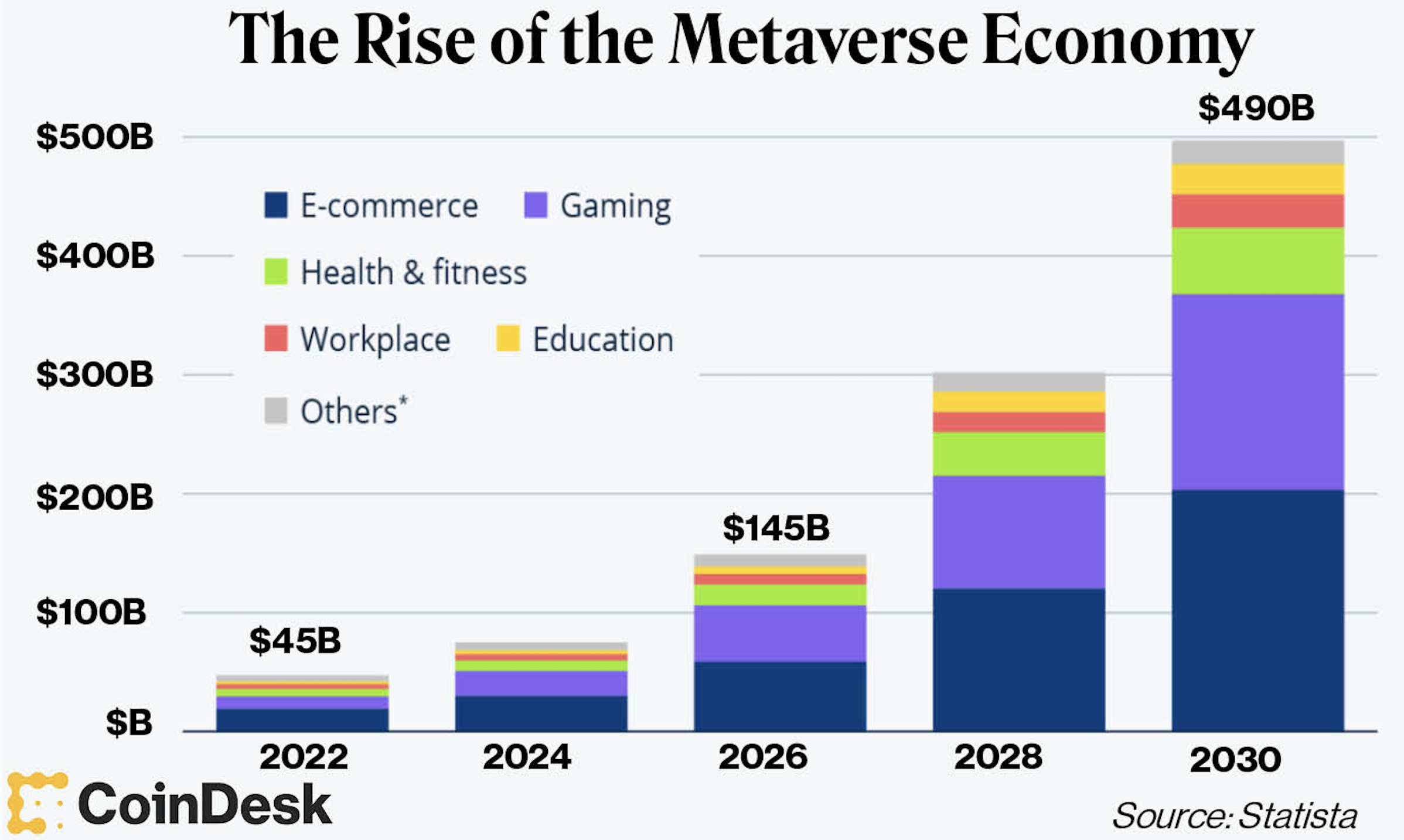

For example, take the once buzzworthy metaverse, part of CoinDesk Indices’ Culture & Entertainment sector. Far less attention is now being paid to the metaverse and its underlying digital assets. Yet, recent data from Statista reports that the metaverse could have $490 billion in market revenue by 2030, up from $45 billion in 2022.

The metaverse is vast and evolving. Brands like Starbucks and the NBA are testing digital experiences. BlackRock just launched a metaverse exchange-traded fund (ETF). Venture capital firms like Pantera and a16z are still throwing millions of dollars at metaverse startups, funding the industry’s growth.

There are 50 assets in CoinDesk Indices’ Metaverse industry group, all with different use cases. Not a bad place to start your digital asset power hour. Cheers.